The rise of COVID-19 is one of the most disruptive forces in recent memory, note Aclaró. Regardless of where you live, the coronavirus is changing nearly every element of modern-day life, whether that is social distancing, the omission of handshakes, and even the purchase of bulk goods for a sustained quarantine.

The rise of COVID-19 is one of the most disruptive forces in recent memory, note Aclaró. Regardless of where you live, the coronavirus is changing nearly every element of modern-day life, whether that is social distancing, the omission of handshakes, and even the purchase of bulk goods for a sustained quarantine.

The coronavirus is also affecting nearly every sector or industry-including the automotive lending industry. Whether you work in the finance department of a car dealership or at an auto lending firm, this Black Swan event may be causing immense stress on your business. We are now living in a world where possible potential risks have become all-too-real risks. Borrowers may find it difficult to pay back their auto loans. Increase in payment default is all but certain. All of us at Aclaró AI are ready to help you manage these new risks.

Regardless of the size of your auto lending business, our sophisticated artificial intelligence ("AI") systems can help your finance team remotely mitigate risk and safeguard your auto loan portfolio. The near-term future is so uncertain, we want to do our part to help your business come out of this crisis with as little damage as possible.

Mitigating Risk Through Near-Term Uncertainty

Aclaró AI's overarching mission is to help our clients leverage AI to grow their dealerships and sales. Our team has worked hard to develop extremely advanced AI algorithms to assess portfolio risk and stay ahead of the unknown.

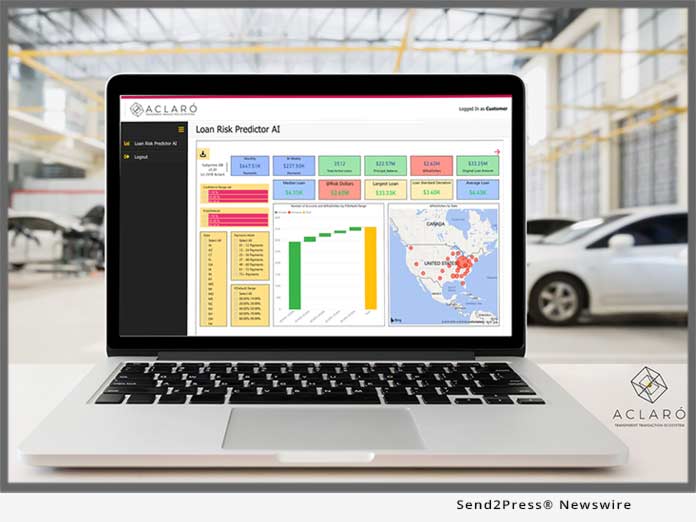

For instance, our TrueView product lets clients get a granular look at potential loan defaults. It lets you easily manage your entire loan portfolio, whether you want to identify some of your riskiest loans, safest loans, or both. Within the TrueView dashboard, you can quickly see metrics like insurance coverage, credit terms, vehicle data, employment information, and more. With the continuing spread of the coronavirus, TrueView can deliver some much-needed peace of mind, as it can deliver clients with upwards of 97% precision on the likelihood of full loan payment or default. TrueView provides default alerts months ahead of the default event. As it has been tested in over two million real-time loan risk evaluations in the past 18 months, TrueView can go a long way in mitigating your overall risk.

TrueView is just one of our products that can help you navigate these uncertain times. Some of our other products include Nexus Score and Nano Profile (which let you access granular information about a prospect's financial health) and EngageMe (which is a consumer engagement app that identifies a borrower's propensity to buy). Using all of these products together, you and your team can capitalize on data to minimize defaults and underwrite loans that are likely to be paid off.

When designing all of Aclaró AI's products, we were laser-focused on making the experience as seamless as possible. Our software lets you access real-time data wherever you are. We like to think of TrueView as a real-life risk management expert that is available anytime and anywhere. We can deliver personalized insights on your auto loan portfolio in real time and offer ideas on how you can minimize risk in the next few months. Even better, our services are not affected by things like quarantines, employee absences, or travel bans. We are always available and can be a trusted asset as your company navigates these near-unprecedented times.

If you are not yet an Aclaró AI client, we invite you to learn more about our platform by clicking here - http://aclaro-4642182.hs-sites.com/aclaro-loan-risk-repayment-insider-look_1-0

To help you manage your risk in these trying times, we have reduced the cost of our platform to start at $999 per month for portfolios of up to $25 million. Ultimately, we make it easy and highly cost-effective for you to leverage some of the most sophisticated AI technology to manage loan risk. Given the uncertain times we are living in becoming an Aclaró AI client is a smart investment.

Navigating Through the Fog

It is unclear when we will return to a sense of normalcy. Some say that we will be back to normal in just a few months while others project that the shakeout will take much longer.

However long it takes, the one thing we do know is that all businesses today must invest more time and resources into risk management. At Aclaró AI, we are laser-focused on helping our clients minimize their auto loan risk. We have developed a complete system that can identify risk and latent demand within your lending portfolio, allowing you to reduce financial damage from this global pandemic.

We invite you to reach out to us to learn more. We would be happy to answer any questions or concerns that you may have. Just click below to schedule a quick introduction call: https://calendly.com/carlos-galarce

Website: https://aclaro.io/

*LOGO link for media: https://www.Send2Press.com/300dpi/20-0211s2p-aclaro-ai-300dpi.jpg

Related link: https://aclaro.io/

This version of news story was published on and is Copr. © Advertising Industry Newswire™ (AdvertisingIndustryNewswire.com) - part of the Neotrope® News Network, USA - all rights reserved. Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.