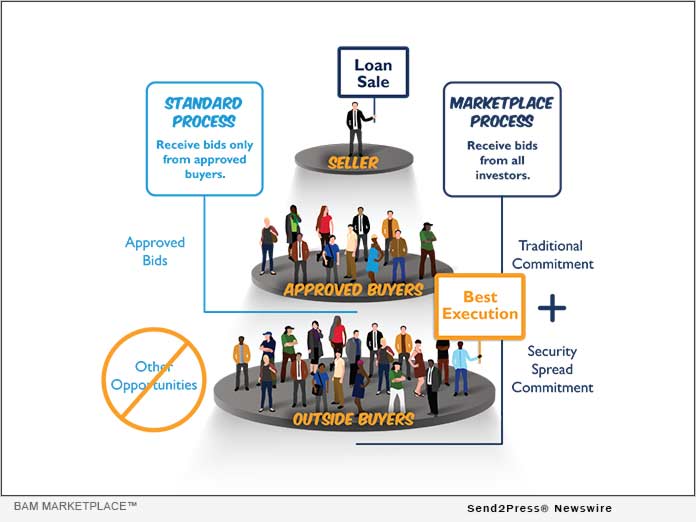

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced the public introduction of BAM Marketplace™. Originally launched to support existing MCT sellers during the 2020 pandemic liquidity crisis, BAM Marketplace now welcomes new buyers and sellers as the world's first truly open loan exchange between unapproved counterparties.

Mortgage Capital Trading, Inc. (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, announced the public introduction of BAM Marketplace™. Originally launched to support existing MCT sellers during the 2020 pandemic liquidity crisis, BAM Marketplace now welcomes new buyers and sellers as the world's first truly open loan exchange between unapproved counterparties.

In the early days of the pandemic, investors bought fewer loans and sellers ran into liquidity issues, especially for specific loan characteristics such as low-FICO government. BAM Marketplace connected distressed sellers with would-be buyers, particularly agency-approved lenders within the MCT client base, some without previous correspondent investing experience. The ability to transact with unapproved counterparties, combined with API-driven automated live pricing, allowed these new buyers to provide a top-tier correspondent experience and quickly build a base of sellers. Today, BAM Marketplace provides quantifiable benefits to lenders of every size for loans of every type.

Sellers benefit by reducing liquidity constraints, growing investor outlets, and increasing loan sale profitability. MCT clients have noted materially improved execution across all loan types. The average spread to cover bids on BAM Marketplace is thirty-two basis points, with that spread extending to forty-six basis points for government production and eighty-nine basis points for low-FICO government loans. Sellers are also finding new outlets for non-owner occupied and second home loans - a key focus area given the new agency limits on such production.

"Gone are the days of a finite set of approved investors, not knowing who has an axe, and incomplete information on who may offer the best price. BAM Marketplace targets systemic issues of limited liquidity and slow turn times for pricing and also helps minimize a lender's exposure to crises and regulatory changes," said Curtis Richins, President at MCT. "It's the only loan exchange where sellers can receive executable bids from unapproved buyers. Through our patent-pending 'security spread commitment', MCT firmly holds its position as the gold standard in best execution and moves one step closer to the ultimate goal - when every loan can be priced by every investor."

Buyers benefit from BAM Marketplace through efficient access to the industry's largest community of sellers and the ability to bid on loans offered by unapproved lenders. Agency-approved lenders can now find unique buying opportunities, even without the prior experience or cost calculations typically associated with launching a correspondent lending channel. MCT's AutoBidTM bid tape pricing solution supports every BAM Marketplace buyer, allowing them to provide automated, algorithm-based live pricing that can be fine-tuned to each seller and loan characteristic.

"By extending the Bid Auction Manager (BAM®) platform, MCT has unlocked additional liquidity and created a turn-key, digital purchasing solution," said Phil Rasori, Chief Operating Officer, MCT. "Proprietary, patent-pending functionality enables immediate access to 'biddable' loan collateral offered by MCT's client base-the largest in the industry."

For MCT clients, BAM Marketplace is part of our core offering with no additional cost or set-up required. It is also available as a stand-alone platform for non-clients.

On June 10, two of MCT's key innovators, Phil Rasori and Justin Grant, will provide a demonstration of the platform and details on the new security spread commitment type. Registration for the webinar is required and easily completed by visiting the BAM Marketplace Industry Webinar registration page: https://mct-trading.com/mct-webinar-introducing-bam-marketplace/.

About MCT:

Founded in 2001, Mortgage Capital Trading, Inc. (MCT) has grown from a boutique mortgage pipeline hedging firm into the industry's leading provider of fully integrated capital markets services and technology. MCT offers an array of best-in-class services and software covering mortgage pipeline hedging, best execution loan sales, outsourced lock desk solutions, MSR portfolio valuations, business intelligence analytics, mark to market services, and an award-winning comprehensive capital markets software platform called MCTlive!

MCT supports independent mortgage bankers, depositories, credit unions, warehouse lenders, and correspondent investors of all sizes. Headquartered in San Diego, California, MCT also has offices in Philadelphia, Healdsburg, and Texas. MCT is well known for its team of capital markets experts and senior traders who continue to provide the boutique-style hands-on engagement clients love.

For more information, visit https://mct-trading.com/ or call (619) 543-5111.

MULTIMEDIA

IMAGE LINK for media: https://www.Send2Press.com/300dpi/21-0520s2p-bam-marketplace-300dpi.jpg

Caption: BAM Marketplace™ is the world's first truly open loan exchange, where buyers can bid regardless of approval status, and sellers receive automated live pricing from every buyer on the platform.

Related link: https://mct-trading.com/

This version of news story was published on and is Copr. © Advertising Industry Newswire™ (AdvertisingIndustryNewswire.com) - part of the Neotrope® News Network, USA - all rights reserved. Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.